- The Financial Diet

- Posts

- My Spending Report From My No-Buy January

My Spending Report From My No-Buy January

January 29, 2026

The start of a new year often brings a quieter kind of reckoning — not a dramatic overhaul, but a desire to better understand our habits and make more intentional choices about how we spend. At TFD, we think this kind of reset works best when it’s grounded in clarity and visibility, especially when it comes to day-to-day finances.

That’s why we continue to partner with Monarch, a budgeting tool that makes it easier to see where your money is actually going, spot patterns over time, and adjust your systems without starting from scratch. Monarch’s flexibility is especially helpful when you’re experimenting with new approaches to spending — whether that’s a no-buy challenge, tighter category limits, or simply paying closer attention to where your money flows.

If you’re using the beginning of 2026 to reevaluate your habits and set more intentional boundaries around spending, you can get 50% off your first year of Monarch with code TFD50. It’s a natural companion to the kind of thoughtful, transparent tracking you’ll see throughout this Nothing-New Year update.

By Holly Trantham

For all of 2026, I’m sticking to a no-buy challenge I created myself: The Nothing-New-Year. There are exceptions, of course; I can buy replacements for things I genuinely need (including for makeup and skincare), I can attempt to find items secondhand if I need something for a special occasion, and I can buy books if I already read and loved them from the library. But the point is to bring nothing net-new into my closet and make better use of what I have, especially after refamiliarizing myself with my closet now that I’m postpartum. My rules are a bit more extensive than that, and you can read them in full here.

Last week, I ripped off the band-aid and laid bare all of my spending for 2025, which you can check out here. In order to get an idea of just how much of an impact my Nothing-New Year could have, I needed to see all of that spending laid out for me. Today, I’m updating you with how the first month has gone!

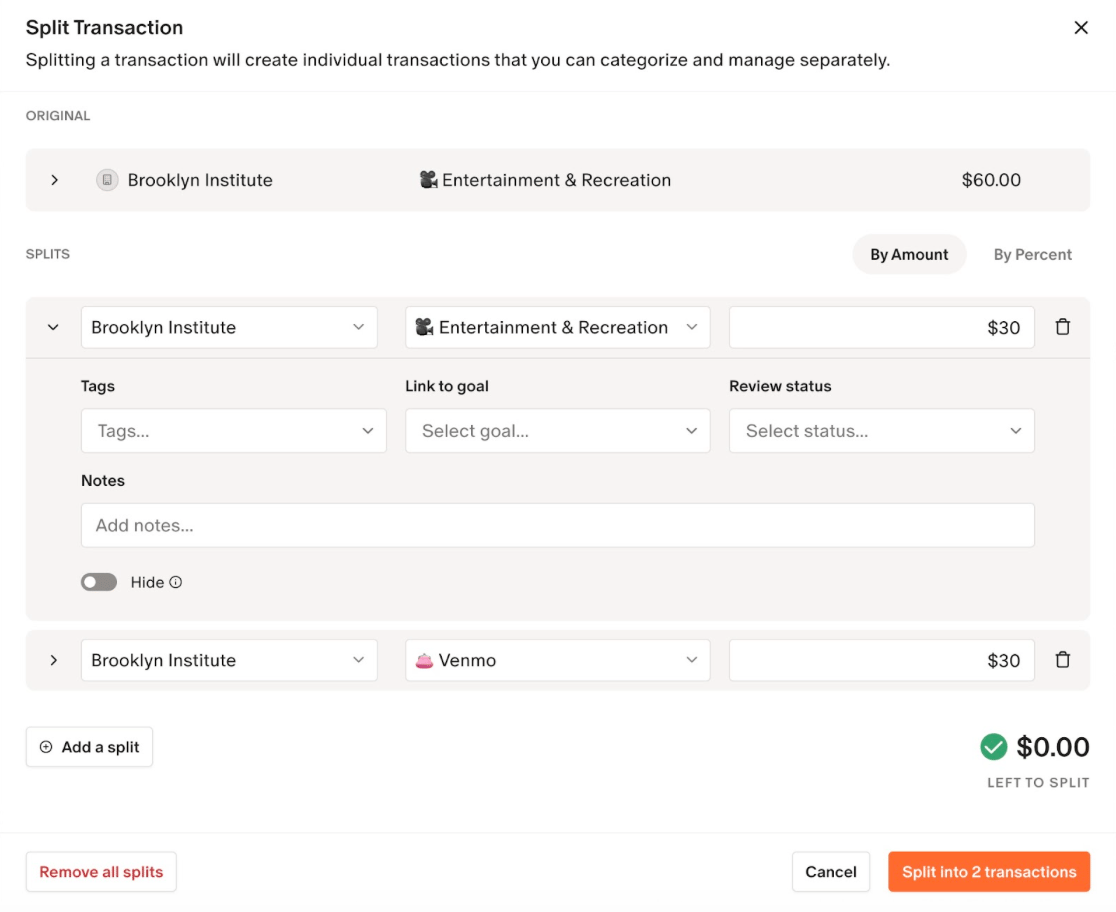

For tracking the year ahead, I made a few changes to my settings in my Monarch app: I created new categories, such as one for (my daughter) Sadie-related spending (clothes and toys/books, mostly) and separating coffee shops into its own category separate from other restaurant spending. Maybe other new parents can relate, but we have been spending way more on coffee and little treats, and way less on actually going out to eat. I also made a very exciting-to-me discovery: Monarch lets you split expenses! This means I’ve been able to split up shared charges in my app to get a better picture of what I actually spent vs. what was Venmoed back to me, and then I can exclude those Venmo charges from my spending reports. See below for a screenshot of how to split an expense on Monarch on desktop:

I also used the “Split Transaction” function to divide up a bookstore purchase that was made up of both gifts and books for Sadie. Very soothing to my category-loving brain!

Here’s my Monarch-generated spending breakdown for the month of January (and yes, I am realizing we still have two days left, but those two days include basically no plans other than staying in to watch the latest season of Bridgerton, and going out to dinner via a gift card and a generous babysitting offer from my dad!):

As you can see, I’ve spent a lot this month in certain categories! You may notice I have two categories for “Entertainment” — one that is pulled from the usual monthly budget, and one that is pulled from our sinking fund. We have one sinking fund we put money into each month (directly taken out of our paychecks, just like our 401K contributions and other long-term savings), which is used to cover bigger just-for-fun expenses. This almost always ends up being travel and Broadway shows. And yes, we splurged on really nice seats to the upcoming Cats: The Jellicle Ball, which I am justifying because I saw it for $60 Off-Broadway and know how amazing it is going to be!

I am happy to share that I stuck to my nothing-new rules this month, with one potential exception! I bought two things for myself: some new embroidery supplies (which I’ve already put to good use), and a copy of our friend Amanda Holden’s sure-to-be-amazing new book while attending her book party. This technically violates my no-new-books rule, since I hadn’t read it yet, but since I was supporting a friend and buying a book I know I’ll love, it feels spiritually aligned with the challenge. Both of these were the only physical/new things I bought myself, and they added up to $101.55 total. Since I’m all set on craft supplies for the foreseeable, I expect this to be $0 next month!

I did, however, spend a fair amount in other areas, notably fitness, gifts, and entertainment. Fitness-related included my regular monthly pass to my local yoga studio (where I did my teacher training last year!), a package of Pilates reformer classes to attend with my best friend (for a new semi-weekly-ish thing we’re calling “Pilates and pierogies,” which is exactly what it sounds like), and registration for a 5-week figure skating class at my local park that starts in late February. So next month, that category will be way lower — just about $150 for my studio membership.

Entertainment also included some far-off plans, including WNBA tickets for a date night in a few months, a ticket to see Stars On Ice with friends (I am trembling with excitement), and admission for an infant playgroup we have started attending as a family. We’ve made plenty of new parent friends through that playgroup and our neighborhood parents’ group chat, and we’re also starting daycare next week, so I don’t anticipate paying for that kind of thing much in the future. So again, mainly one-off expenses we likely won’t have as much of next month.

The gifts category is trickier, because this is a busy time of year for my family’s birthdays. This month covered birthday presents for my best friend and both of my nephews, plus a baby shower gift, and a few extra copies of Amanda’s book I bought to be supportive and give out to friends. Next month, we have both my mom’s birthday and a wedding gift to account for, so I expect the spending to be similar.

My personal spending was mostly made up of a facial (plus a few replacement personal care items), which was much appreciated with this extremely drying winter weather. Honestly, I am considering getting a lot more of these this year than I have in the past — I really love the experience of getting them, and now that I’m spending so much less on things for myself, I have a lot more budget space for them.

Finally, I am aiming to keep Sadie-related spending to under $300 a month — this month was less than $250, so we’re in good shape there. It’s very difficult not to buy your baby every cute outfit you come across, but when you start realizing how infrequently they actually end up wearing individual items, it does get easier 🙃

I’m also really surprised to see just how little I’ve spent on dining out! It does make sense, since this was our first month back to work since being on parental leave, and we’ve been without childcare for the most part. We haven’t exactly had the most energy for going out, either with or without the baby. As she starts daycare next week, I think this will definitely go up. But, purposely or not, keeping it low has worked out well for my other spending this month.

Now that my Nothing-New Year is in full swing, I’ll be updating you all on my spending here once a month!