- The Financial Diet

- Posts

- Here's How Much I Could Save From My 2026 No-Buy Challenge

Here's How Much I Could Save From My 2026 No-Buy Challenge

January 22, 2026

The beginning of a new year naturally brings on self-reflection — a moment where many of us feel ready to take an honest look at our habits, not in a “new year, new me” way, but in a more grounded, sustainable one.

Here at TFD, we think this kind of reset works best when it’s rooted in visibility, which is why we are once again sharing how much we genuinely love Monarch. Monarch makes it easy to see your spending patterns clearly, set realistic goals, and automate the systems that support them over time.

If you’re using the start of 2026 to reevaluate how and why you spend, make sure to take advantage of our discount — 50% off your first year of Monarch with code TFD50 — a useful companion for the intentional reset Holly is talking about in this series.

By Holly Trantham

For all of 2026, I’m sticking to a no-buy challenge I created myself: The Nothing-New-Year. There are exceptions, of course; I can buy replacements for things I genuinely need (including for makeup and skincare), I can attempt to find items secondhand if I need something for a special occasion, and I can buy books if I already read and loved them from the library. But the point is to bring nothing net-new into my closet and make better use of what I have, especially after refamiliarizing myself with my closet now that I’m postpartum. My rules are a bit more extensive than that, and you can read them in full here.

As I mentioned in my intro to this challenge, I don’t have a specific savings goal in mind. I want to create more breathing room in my budget for experiences, getting back into certain activities (particularly exercise-related) that were a big part of my life before I got pregnant, and occasional treats-to-self I usually never make space for (think the occasional massage or facial). I do think I will be spending less and saving more overall, but in order to accurately measure that, I need to establish a baseline: everything I spent in 2025.

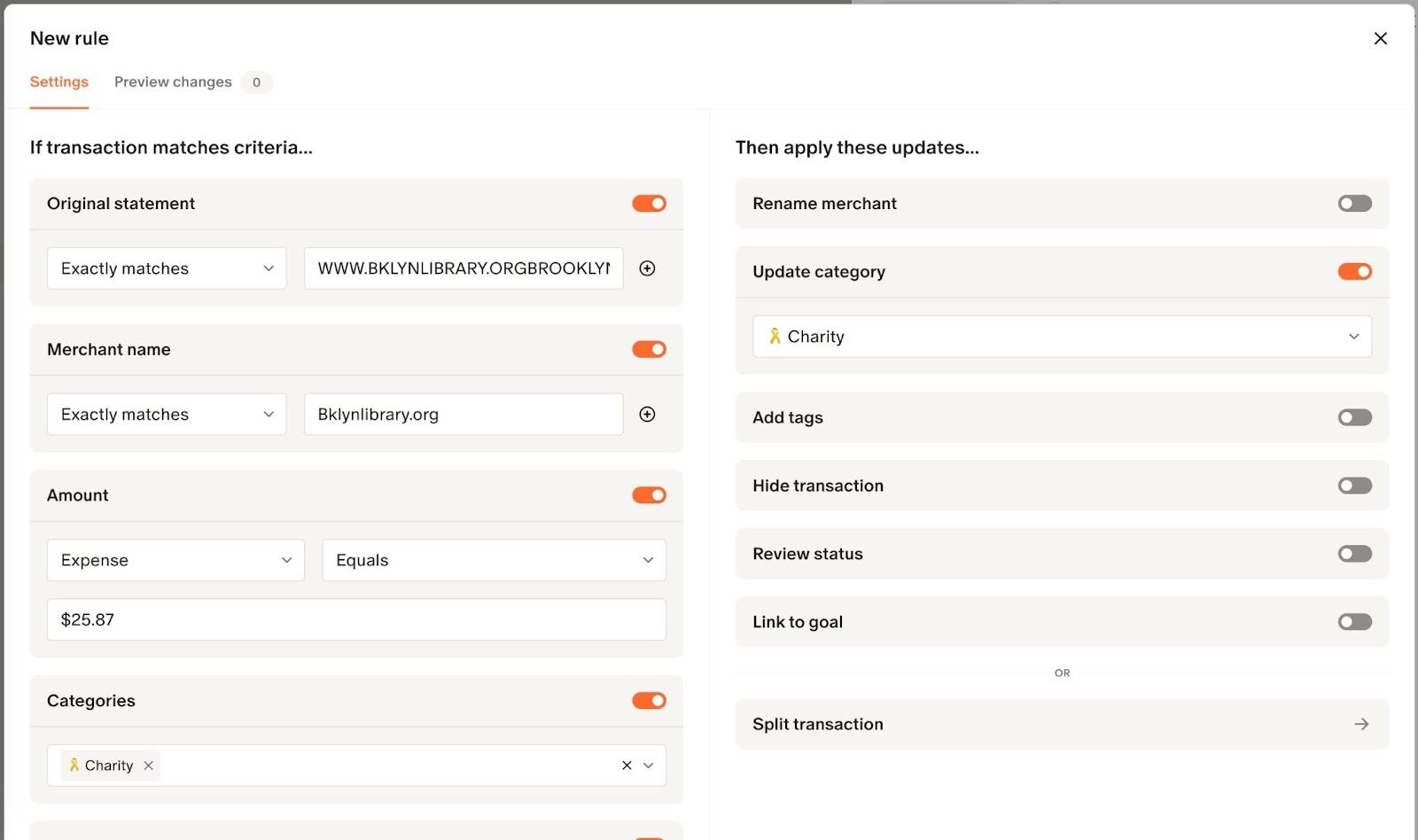

I had already done this exercise a bit in the middle of last year when I added up everything I’d spent as a pregnant person up to that point — check that out here if you’re feeling nosy. Now that I wanted to see my total spending for 2025, thanks to Monarch, adding up everything was extremely easy! I started using the app last summer, and it made it super simple to import all of my accounts and transactions. It categorizes transactions pretty accurately, but when it gets something wrong or you want to simplify the categories you use, you can create a “rule” to categorize all transactions from a specific institution or retailer however you want. For instance, I created a rule to categorize all of my recurring monthly donations to The Brooklyn Public Library as “charity” transactions.

See below for how this looked on desktop:

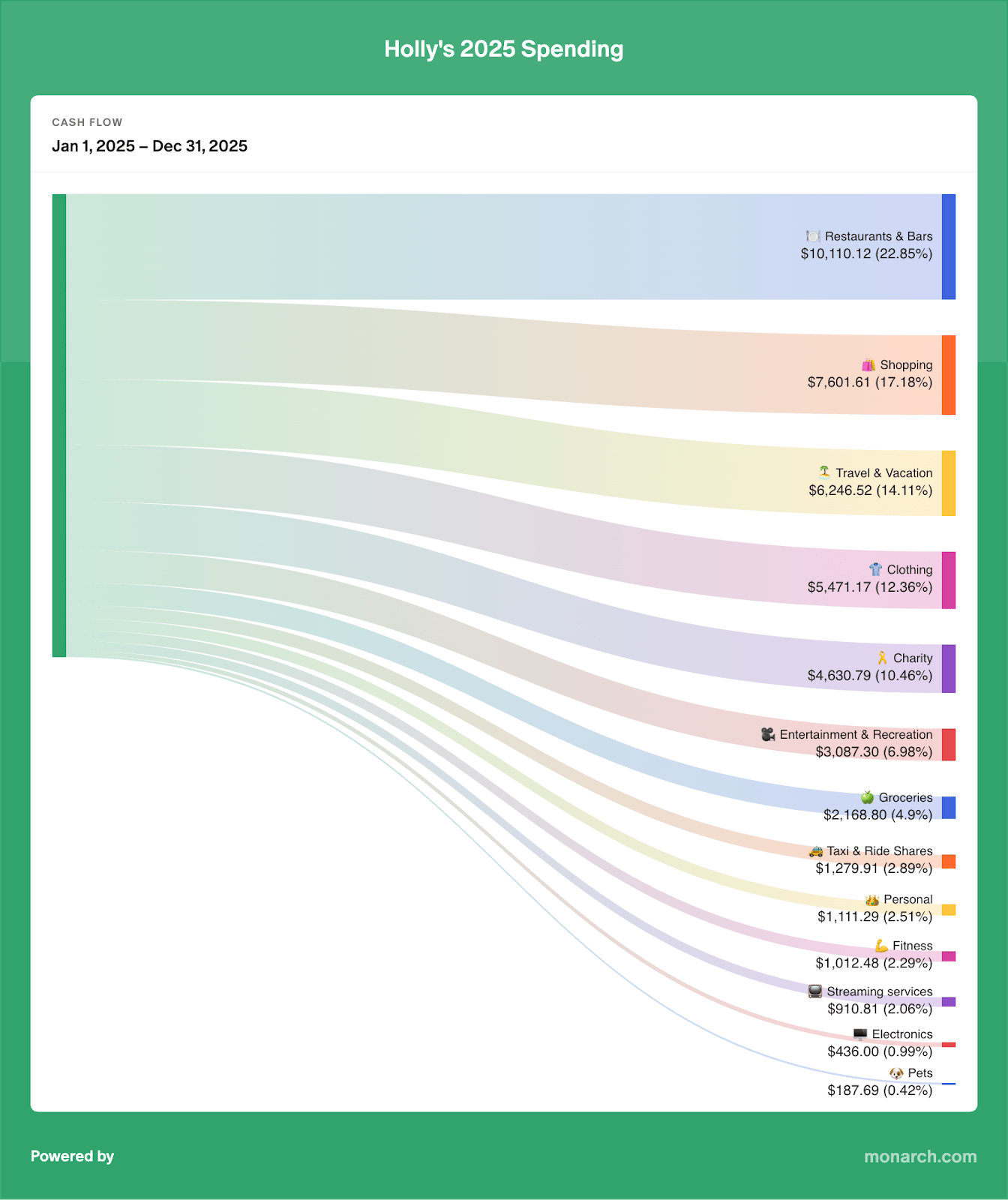

Under the “Reports” tab on my dashboard, I was able to pull my entire discretionary spending for 2025. It even let me download a super cute Sankey chart to illustrate where all of my money went, which you can see here:

A few caveats before you are totally thrown off by some of these numbers: I’m married (to Peter) and now have a 4-month-old baby (Sadie). My credit card gets better points back for restaurants and dining, so we put almost all of our going-out spending on my card instead of Peter’s. (On the flip side, I did very little grocery shopping while pregnant, so almost all of that spending for the year went on Peter’s card.) My past spreadsheet-obsessed self would be imploding to hear that I don’t get hyper-specific in my budgeting these days (though Monarch definitely lets you do so if you want!), so I didn’t separate out spending for Sadie from my own personal spending. Hence the “Shopping” and “Clothing” categories include plenty of purchases for her — I’d say about 20% of the clothing spending was baby clothes for her (listen, I’m just one woman) and 50% of “Shopping” was baby-related furniture and home items. “Shopping” also includes gifts for other people, which I might start separating out in the reporting for 2026, as well as any non-clothing/non-personal care shopping, such as books, kitchen and home items, craft supplies, etc.

For my no-buy challenge, I’m mostly concerned with these numbers:

Clothing: $5471.17

Shopping: $7601.61

Personal: $1111.29

I don’t see my “Personal” category going down a ton — this is mostly trips to Ulta and haircuts, which I get once a quarter. But since I am not buying any net-new skincare/makeup, we’ll see! I am also working with a $300 monthly budget for Sadie-related purchases; I’d love to stay under that, but it’s always tricky to try to predict exactly what size your growing baby will be at a specific point in time (though I have become a frequent visitor to our local kids’ consignment shop, and we’ve participated in clothing swaps and gotten plenty of hand-me-downs!). If I only spent that $300 a month on Clothing/Shopping, aka $3600 for the whole year, I’d be at just over a quarter of what I spent in 2026. This isn’t super realistic considering I will likely need to buy some replacement items, pre-planned home expenses, gifts, and craft supplies. But if I can cut that spending in half this year, I will consider that a humongous win!

Next week, I’ll be back with my first monthly check-in to keep you all ~abreast~ of how things are going!