- The Financial Diet

- Posts

- How I’m Budgeting Less, But Saving More: Week #2

How I’m Budgeting Less, But Saving More: Week #2

July 28, 2025

Hello and welcome to The Financial Diet's weekly newsletter!

We'll be in your inbox every Monday sharing our best tips to keep your money, career, and life in order.

Make sure to read through the entire newsletter so you don't miss anything! Thank you for being a part of this special little corner of our community!

❤️ TFD

As I’m writing this, it’s late evening on Monday, July 21, and I’m just back from my last pre-baby vacation with my husband. I know that, thanks to jetlag and third-trimester insomnia, I won’t be falling asleep anytime soon. So, naturally, it’s time to check in on my budget.

ICYMI, I’m currently documenting my July budget as I test out the Monarch app after many years of being a spreadsheet-first budgeter. Read through the first installment in full, but here’s a quick recap:

I’m spearheading this challenge, but my husband, Peter, and I combine our finances, so the budget numbers include spending across all of our accounts.

While we’re so excited to become parents, we’ve also had several months of overwhelming/first-time/one-off expenses, and we really need to rein it in in order to start preparing for the expected (and unexpected) expenses of parenthood. Top priority: building a big cushion before we have to start paying for infant daycare in early 2026.

I decided to put us on the Monarch app to track our spending, but use the “flexible budget” option rather than tracking specific categories — especially since this month was going to include such lopsided spending as our last big vacation before the baby, as well as hosting many family members coming to town for our baby shower.

Monarch helped me figure out that as long as we keep our flexible spending to less than $4,400 for the month of July, we’ll be able to put away an extra $1,500 towards those impending-child expenses.

In order to achieve this with some potentially-spendy events happening, we decided to basically cut out our personal “allowances” for the month, as well as any non-vacation/non-family-visiting restaurant spending.

When I last checked in, we were about two weeks into the month and a day or two into our vacation, and our flexible spending was less than $1,000 for the month. I’m really glad we kept our spending pretty low for that first half of the month, because boy…did we enjoy ourselves on this vacation.

I have to admit that I wasn’t paying super close attention to our spending during our trip, since I wanted to be in the moment as much as possible. I also felt like, since it was lower-key than most of the trips we take (with most of our time spent gentle hiking, reading, or playing cribbage), we would naturally keep our spending lower than usual. I think this ended up being mostly true, but considering we were still going out for most of our meals and staying in pretty expensive areas, our total spending while away was still way more than the first two weeks of July.

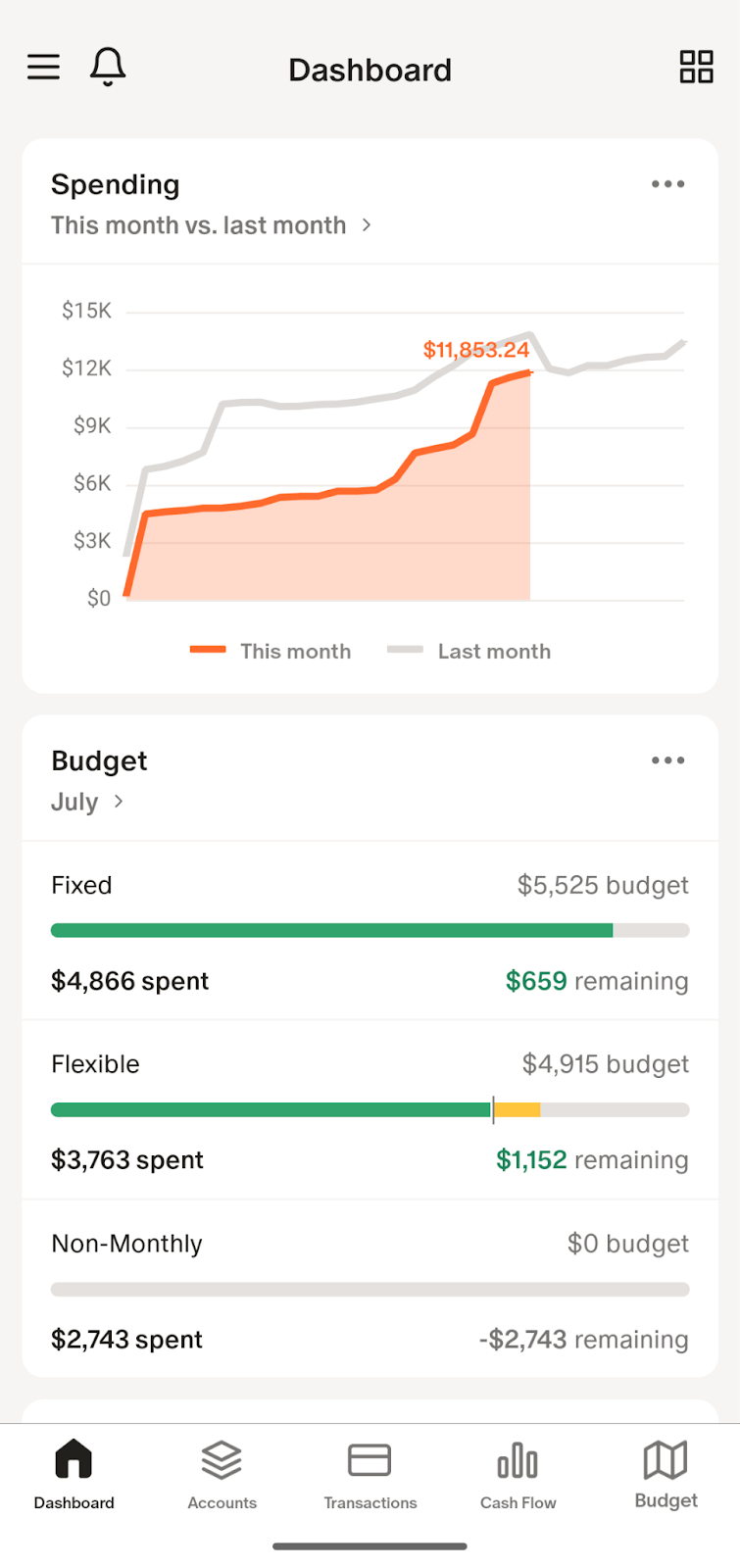

Below is a screenshot from my Monarch app showcasing our remaining spending for the month. Important update: you’ll see that the “flexible” category is now $4,900, not $4,400 as it was previously. This is because I paid up front for a few group tickets to WNBA games (supporting the New York Liberty being one of my biggest/happiest entertainment expenses of summertime). This means I’ll be reimbursed about $500 from friends and family who owe me for their tickets. I just added that amount to my monthly income in Monarch, and then increased the flex budget total to reflect that update!

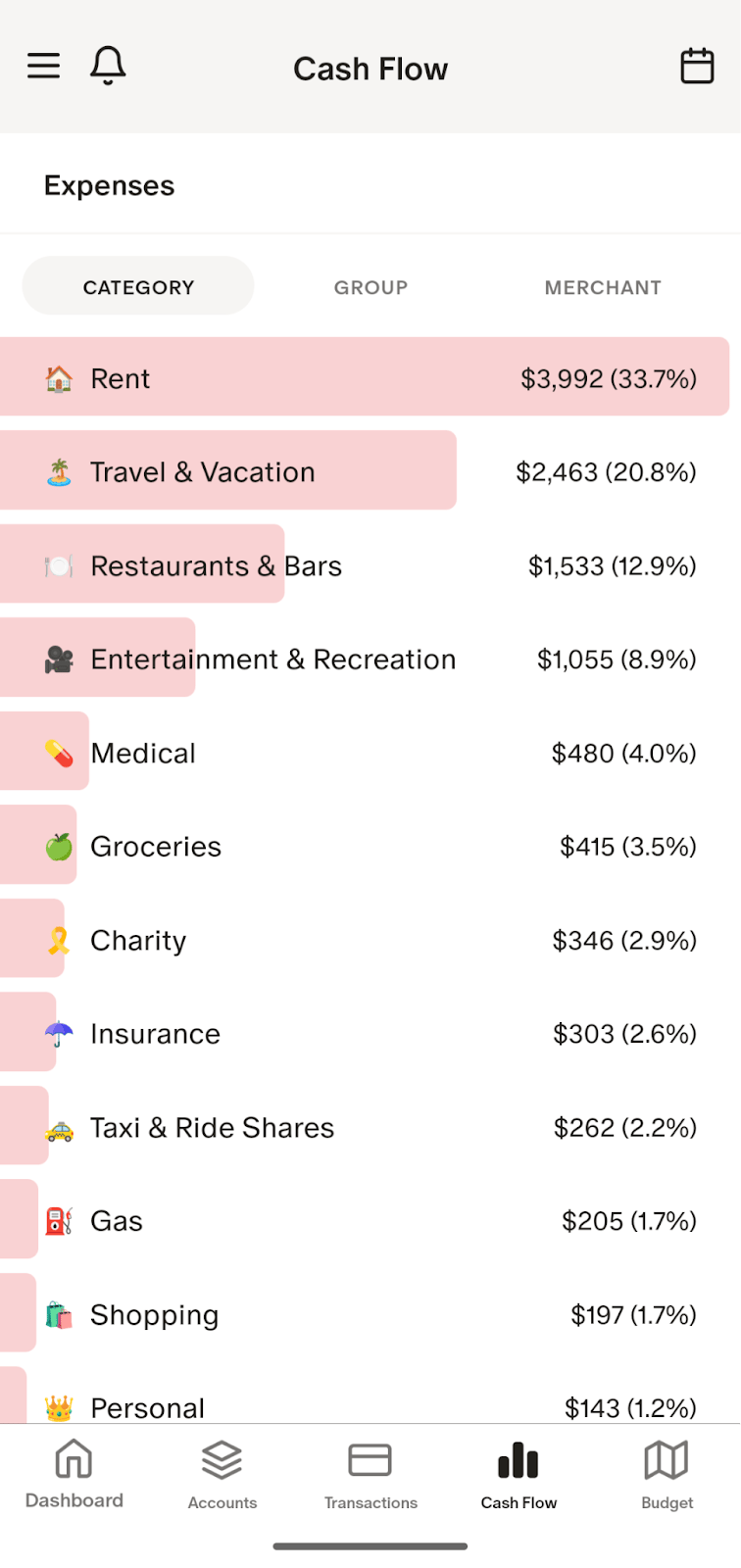

A reminder that “non-monthly” expenses include pre-booked vacation expenses (like hotels and rental cars) and medical expenses that come out of our sinking funds/HSA, so they don’t impact our monthly budget. When I look closely at the categories, I can see our biggest category has been restaurants/dining out, which is over $1500 for the month of July so far. All but $100 of that was from dining out on this trip. Expected, tbh! The majority of the rest of our flexible spending for the month has been the basketball tickets, groceries before and during the trip, a few souvenirs and independent bookstore hauls from our vacation, and bookings for a whale watching tour. I also had an unexpected $80 expense for a nice-but-not-super-fancy replacement wedding band after a freak hand-stuck-under-rock incident crushed both of my rings — a repair job for future me to deal with/pay for. (Fingers were, luckily, unharmed!) Overall, we haven’t purchased much in the way of “things,” and I think that has definitely helped us stay under budget without having to meticulously track.

Including those extra basketball ticket costs and all of our non-planned vacation spending, we now have about $1,150 left to spend over the remaining 10 days of the month in order to reach our savings goal. Of course, this feels like a plenty-big number — until I remember the fact that we have family coming to town for five days, which somehow always leads to me spending way more than I think it will. We will definitely cover a few meals, as well as plenty of groceries for at-home brunch and dinner a few nights (and plenty of snacks for my toddler nephew, and we all know how that adds up!). I’m typically a no-push-notifications kind of a girl (aside from calls/texts/Slack during the workday), but I went ahead and turned them on for Monarch to help keep us on track.

Screenshot below if you are curious for the category-specific spending breakdown, though keep in mind this includes fixed and non-monthly expenses, as well as flexible ones!

In my next installment, I’ll be back with updates on how our family-visiting spending went, including how tight of a budget we’ll be left with for the remainder of July!

Download Monarch and use code TFD50 for 50% of your first year. Dozens of TFD community members use and love Monarch. Click here to get started!

1. I haven't cooked since I basically I found out I was pregnant/stopped having my normal energy level, which means my husband has been perfecting the art of recognizing when a recipe will be low-effort, but high-payoff. This turmeric-pepper chicken, which he made with rice noodles, seemed super easy and made delicious leftovers!

2. I just read The Wedding People while on vacation and really loved it. I'm often wary of books that reach such a high level of hype/popularity (especially after getting burned so badly by one romantasy series that shall not be named...), but this one actually lived up to it! Definitely read the content warnings on this one first!

3. As someone who has kind of fallen out of love with podcasts in recent years, Jake Cornell's new show Walk With Me Here on Substack is reviving my desire to listen to someone ramble on in my ear. Full disclosure, Jake is one of my dearest friends, so this is a little biased — but he's the most effortlessly funny person on the internet, in my opinion, and if you enjoy his TikToks, I think you'll love hearing his podcast/inner monologue!

4. It has now been about a year since I became a bona fide Sports Fan, AKA started keeping up with the WNBA after going to a New York Liberty game, having a great time, loving the super hyped-up and inclusive environment. I have never been a fan of sports before this and I really never understood the appeal. But I honestly recommend going to a game and seeing if you get into it — I'm now a person who checks the scores of games of other teams in the league and looking at box scores to dissect the Liberty players' stats. I've gotten to bond with people over the Liberty and introduce friends to women's basketball, and it has honestly added so much to my life. I guess this is also just a recommendation to be open to new experiences!

5. My husband and I were just on vacation and spent a lot of our downtime playing cribbage, and it was a great way to pass the time/not be on our phones. I highly recommend finding two-person games to play with a partner/roommate/friend during moments when you would otherwise be bored, but don't have the energy for a full-blown game night. I also really love Jaipur!

While this section includes products and services from our paid partners, we only feature brands we genuinely like and use—and think you would, too.

BUDGETING — Monarch: Our recommended Mint replacement! As we already shared in the main section of this newsletter, we highly recommend using Monarch to take the guesswork out of managing your money — use it to budget, set goals, and actually understand where your money’s going. Even better: there’s no ads, no selling your financial data to third parties, and no "premium only" upsells — just a clean, secure app that makes managing money feel way less overwhelming (and actually kinda fun?).

FINANCIAL ADVISORY — Advisor.com: Dozens of people in the TFD community already trust and use Advisor! They’re one of the only financial advisory companies offering their services for a fixed, flat annual fee. Their team of advisors work for you, not commissions, and help you to achieve your financial goals through planning, investing, and more, no matter where you’re starting from.

INVESTING — Betterment: If you’ve been wanting to start investing but feel overwhelmed by where to begin, Betterment makes it super simple—even if you’re not a financial expert. With automated investing and goal-based planning tools, they’ll help you grow your money responsibly and sustainably over time. It’s a great option if you want to take control of your financial future without having to become a full-time market expert.

DIGITAL SAFETY — Aura: Aura is the simplest way to keep yourself, and your money, safe online. Aura is a digital safety solution to help keep you safe from identity theft, financial fraud, and online threats. Protect your privacy and secure your data across sites, apps, and devices — so you can enjoy the internet worry-free. Aura has up to 250X faster fraud alerts than the competition and all subscription plans are backed with $1,000,000 in identity theft insurance.

The Society at TFD is our members-only community with access available on both YouTube and Patreon. Joining The Society is the best way to directly support TFD! The Society offers the exact same things on both platforms, so choose whichever one you prefer!

We offer 3 tier options:

The Society at TFD Lite: $2.99/month

Monthly office hours with Chelsea to chat and get your personal questions answered

Access to our monthly book club hosted by TFD Creative Director, Holly

Illustrated tech backgrounds every month

Access to Society Discord

The Society at TFD: $4.99/month — includes everything in the $2.99 tier plus:

Monthly ad-free extended director's cut videos from Chelsea

Exclusive members-only events and workshops

Complete post archive (including exclusive members-only videos of Chelsea ranting on different topics)

The Society Premium: $9.99/month — includes everything from the previous tiers plus:

Weekly newsletter from Chelsea

Monthly multi-page workbook/guidebook on a different topic each month

Members-only capsule podcasts