- The Financial Diet

- Posts

- My Flexible-Budgeting Challenge As A Super-Strict Budgeter

My Flexible-Budgeting Challenge As A Super-Strict Budgeter

July 21, 2025

Hello and welcome to The Financial Diet's weekly newsletter!

We'll be in your inbox every Monday sharing our best tips to keep your money, career, and life in order.

Make sure to read through the entire newsletter so you don't miss anything! Thank you for being a part of this special little corner of our community!

❤️ TFD

If you’ve been following TFD for a while, especially here on the newsletter or through our members-only workshops, you probably know at least one thing about me: I am completely obsessed with spreadsheets. I have one for everything, from planning out things to buy for our nursery and updating our apartment with a baby on the way, to hyper-detailed itineraries for every vacation I’ve ever planned. And my husband, Peter, and I have been using some version of the same budget spreadsheet template since we got married, almost six years ago.

Spreadsheets and super-detailed budgets are my comfort zone. And I’m really proud of where they have gotten Peter and me over the years — budgeting has allowed us to take care of the big things, like max out our retirement accounts and save a lot of extra money in a nest egg, and the “smaller” things, like take at least one big vacation every year and buy plenty of tickets to live theater, one of the biggest perks of living in New York City. Having specific budget categories has always helped my Capricorn brain not go overboard, because I can very clearly delineate how going over in one line item would impact the rest of my budget.

(I know this ultimately does not determine anything and will only resonate with some people, but I’m not kidding about the Capricorn brain thing. I have six Capricorn placements in my chart.)

Lately, however, I have been feeling unusually overwhelmed with our budget. We’ve had so many more one-time expenses than we typically do thanks to baby prep, which I broke down in a previous newsletter. We also now have our biggest baby-related expense to start saving and budgeting for: infant daycare. This will start when our kid is four months old — around February 2026 depending on when she actually decides to join us earthside — and will be pretty darned expensive thanks to the general cost of childcare in NYC. We’ve gone over budget more frequently than usual because I’m just not as able to accurately plan expenses ahead of time. And I don’t want to delude myself into thinking this will get better when the baby comes; if anything, our spending will start to be even less predictable.

We’ve already been able to save a few thousand dollars towards our first year of daycare, mainly thanks to a few commission payouts on my end, and we are planning to pay for a decent chunk from Peter’s end-of-year bonus. But we also know that we’re going to eventually have to work daycare costs into our budget, so adjusting to spending less is the name of the game here.

So I decided to challenge myself (and Peter, though let’s be real here: keeping tabs on the budget is my territory, tysm) to something pretty new to me: saving money without tracking every single dollar meticulously. I decided to download Monarch, because even before we started working with them, I had heard many good things about the platform from the greater TFD community. Plus, Monarch has a “flex budgeting” feature that seemed like it would make it really simple to keep tabs on our spending without having to zoom in on individual expenses. I also wanted to do this challenge during the month of July, while we were still a few months out from having a literal child. Of course, this is not perfect timing, as no month could possibly be. July was to include a vacation to the beautiful, expensive Pacific Northwest, as well as hosting many of our family members for our baby shower.

(I’m going to start sharing some numbers, but keep in mind: we make good money. Yes, this challenge, as well as accommodating a child into our budget, is going to be an adjustment, but that doesn’t mean we are going to be uncomfortably stretched. If anything, I’m trying to adjust our way to a new-normal level of spending.)

In order to keep our spending in check during this busy month while still enjoying ourselves and our vacation, we’re sticking to a few loose rules:

Limiting our “personal allowance” budgets. This is usually around $500 a month we each get to spend however we want (though we’ve allocated more for me over the past few months, ever since I needed to start getting maternity clothes). This month, even though we’re not tracking individual expenses, we’re both on board with pausing pretty much all personal spending — that means workout-app classes instead of in-person ones, reading books we already own, no new clothes/shoes/makeup, etc.

Basically doing a no-restaurant-spending challenge outside of our vacation and family visiting.

No impulse-buying cute baby clothes, even while on vacation. This has been a huge weakness of both of ours as of late.

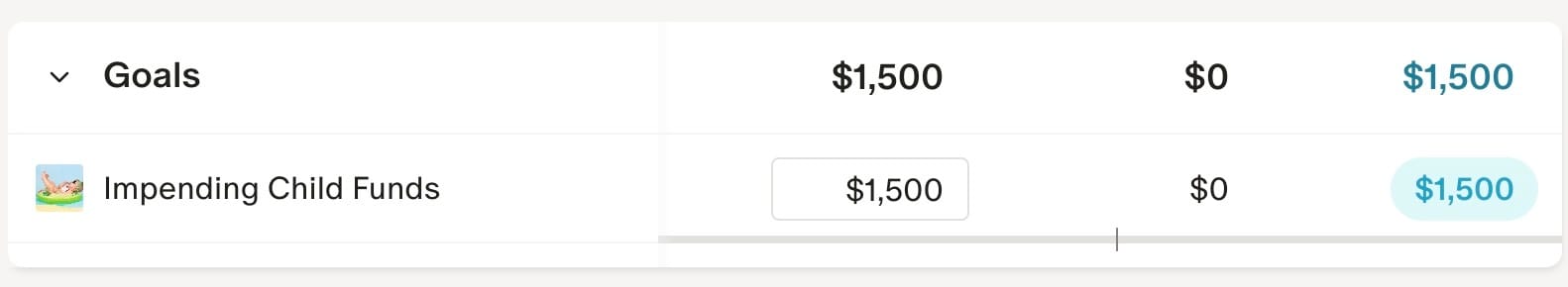

In Monarch, I synced all of our accounts, which was honestly really easy to do (some accounts took longer to verify than others, but all told, we were done in less than an hour). I then set a goal of saving $1500 towards our impending child expenses this month, and adjusted the rest of our budget from there.

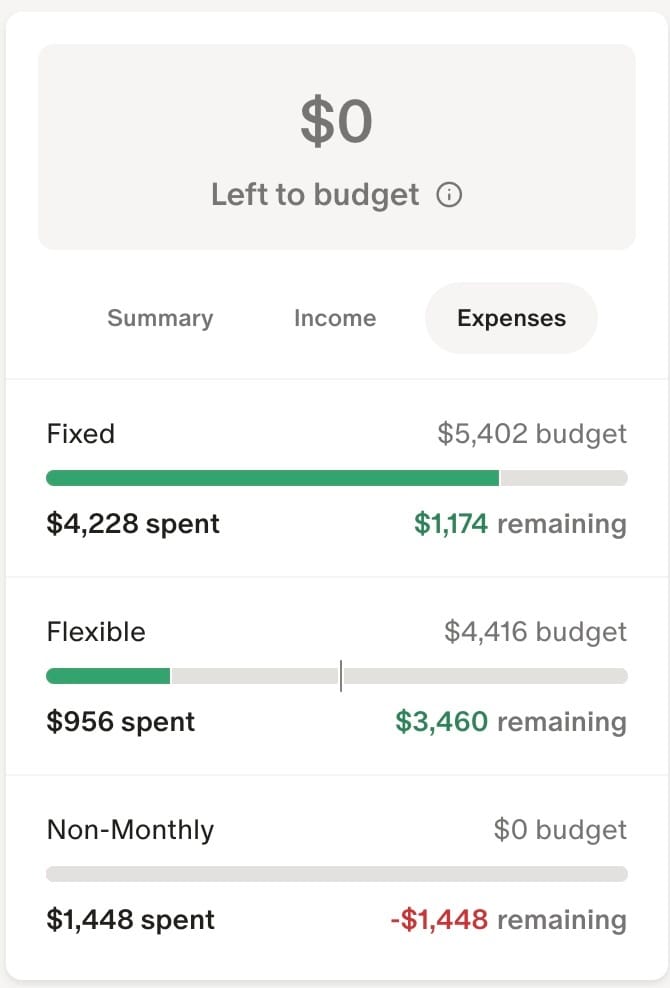

This set our “flex budget” to $4400 for the month of July (between the two of us, not each). As I’m writing this, it is July 13th, and we are a few days into this last vacation before our 4-being household (two adult humans + two adult cats) becomes 5. (I typically excel at getting all my work done prior to a vacation but again: overwhelmed!) So far, our monthly spending looks like this:

“Fixed” costs include our rent (the majority of what has been “spent” so far), phone/internet/utilities, monthly memberships/subscriptions, recurring charitable donations, etc. “Non-monthly” expenses so far this month include pre-planned costs for this vacation (rental car, accommodations) and some healthcare expenses, all of which are being covered by our sinking funds or HSA, so nothing I am budgeting for from this month’s income. The “flexible” category is what I am focused on: as long as we stay under that number, we will be able to save that extra $1500 towards our future childcare expenses.

Considering we are almost halfway through the month, I am really happy with where our spending currently stands! That being said, I also know that this vacation is going to eat up quite a lot of that flexible spending. Our pre-planned costs won’t be coming out of this month’s budget, but all of our day-of costs like activities, dining, gas, ferry tickets, etc. will be.

I plan on doing a check-in every week for the month, and I’ll report back here with our progress! I’ll also be exploring more of Monarch’s features during this time, such as the net worth tracker and goal forecaster. Let me know if there’s anything specific you’d like to read about from this challenge, or from my experience using Monarch generally!

Download Monarch and use code TFD50 for 50% of your first year. Dozens of TFD community members use and love Monarch. Click here to get started!

Before I get into my recs, here is a shameless plug to join me Thursday afternoon (12:30pm et) for our July Society workshop! I’ll be hosting Creating Your Personal Brand Without Feeling Salesy. This workshop is available for all Society members at our $4.99 & up tiers! I haven’t hosted a workshop in a very long time so I’m excited to hang and share my thoughts and insights with everyone! Hope to see you there!

Anyway, let’s get into my recs…

Random things I’m into lately:

These Medicube toner pads for the hormonal acne I’ve been dealing with for the last few months. Also the ilike clay spot treatment has definitely helped — and this product also works a bit like a concealer during the day.

The Social Currency newsletter from Sammi Tannor Cohen. As a marketer, I love the tech/culture/marketing insights and bts info she shares every week.

Esas fragrances. This may be another repeat rec but once I find something I like, I double down on it. I am very very sensitive to synthetic fragrances because I have cystic fibrosis — my body can clock anything with harsh chemicals very quickly. I am capital O Obsessed with their Sweet Cream & Vanilla perfume. Since it’s all natural, it’s a bit on the pricey side, so I’d recommend getting their scent discovery kit before committing to anything.

Shows I’m currently watching:

The Buccaneers on Apple TV — I think I’ve recommended this show before here but the new season is out so it’s the perfect time to catch up if you’re into shows that give Bridgerton vibes

Building The Band on Netflix — I’m not normally into music competition shows but I came for AJ McLean hosting and stayed for the incredibly talented singers

Better Late Than Single on Netflix — While music competitions aren’t normally my thing, Korean reality shows are my thing because they’re always swoony and charming

While this section includes products and services from our paid partners, we only feature brands we genuinely like and use—and think you would, too.

BUDGETING — Monarch: Our recommended Mint replacement! As we already shared in the main section of this newsletter, we highly recommend using Monarch to take the guesswork out of managing your money — use it to budget, set goals, and actually understand where your money’s going. Even better: there’s no ads, no selling your financial data to third parties, and no "premium only" upsells — just a clean, secure app that makes managing money feel way less overwhelming (and actually kinda fun?).

FINANCIAL ADVISORY — Advisor.com: Dozens of people in the TFD community already trust and use Advisor! They’re one of the only financial advisory companies offering their services for a fixed, flat annual fee. Their team of advisors work for you, not commissions, and help you to achieve your financial goals through planning, investing, and more, no matter where you’re starting from.

INVESTING — Betterment: If you’ve been wanting to start investing but feel overwhelmed by where to begin, Betterment makes it super simple—even if you’re not a financial expert. With automated investing and goal-based planning tools, they’ll help you grow your money responsibly and sustainably over time. It’s a great option if you want to take control of your financial future without having to become a full-time market expert.

DIGITAL SAFETY — Aura: Aura is the simplest way to keep yourself, and your money, safe online. Aura is a digital safety solution to help keep you safe from identity theft, financial fraud, and online threats. Protect your privacy and secure your data across sites, apps, and devices — so you can enjoy the internet worry-free. Aura has up to 250X faster fraud alerts than the competition and all subscription plans are backed with $1,000,000 in identity theft insurance.

The Society at TFD is our members-only community with access available on both YouTube and Patreon. Joining The Society is the best way to directly support TFD! The Society offers the exact same things on both platforms, so choose whichever one you prefer!

We offer 3 tier options:

The Society at TFD Lite: $2.99/month

Monthly office hours with Chelsea to chat and get your personal questions answered

Access to our monthly book club hosted by TFD Creative Director, Holly

Illustrated tech backgrounds every month

Access to Society Discord

The Society at TFD: $4.99/month — includes everything in the $2.99 tier plus:

Monthly ad-free extended director's cut videos from Chelsea

Exclusive members-only events and workshops

Complete post archive (including exclusive members-only videos of Chelsea ranting on different topics)

The Society Premium: $9.99/month — includes everything from the previous tiers plus:

Weekly newsletter from Chelsea

Monthly multi-page workbook/guidebook on a different topic each month

Members-only capsule podcasts