- The Financial Diet

- Posts

- How To Afford The Career You Actually Want

How To Afford The Career You Actually Want

October 27, 2025

Hi everyone, and happy Monday!

Today is the last day of the first week of my book, Having People Over, and per my video today — I really care that it has a great first week! First week sales are incredibly important for an author (and for a book's lifespan), and I especially want this book to be stocked as widely as possible heading into the holiday season, as it is fundamentally a holiday book! If you haven't yet, please consider ordering a copy for yourself (or as a gift) anywhere you prefer to buy books by clicking here.

Thank you again for all your immense support for this book so far — especially on my tour! I'm seeing nearly 200 of you in Chicago tonight, and we're going to be adding five more cities very soon! Having People Over is out everywhere, so happy hosting!

And, as always, thank you for being a part of this special little corner of our community!

❤️ Chelsea

By Danielle Nicholson

Your “dream career” or your “ideal career” isn’t a specific job; it’s something you build, piece by piece. It means creating a life where your work aligns (enough) with your values, goals, and interests, while also supporting your long-term physical, mental, and financial health. Building this kind of career takes slow, intentional strategy and financial planning so you can take risks without harming your future. In this economy, this kind of career can feel completely out of reach, but I choose to believe it isn’t. There’s certainly privilege involved, and you can’t always achieve your exact vision, but you can still stitch together the pieces that are accessible to you and build a life that’s rich and meaningful.

As a holistic career coach, this is the backbone of my approach when helping clients figure out their next steps, but it’s also how I approach my own life. Like a lot of the TFD community, I’m a gal with a wide range of interests and goals: I’m finishing grad school for counseling, running two small businesses (career coaching + instructional design for therapists), and quietly writing queer romances on the side. But all of those things have their ebbs and flows. If we want to pursue our passions while also surviving these difficult times, we can’t do everything at once. We have to take our time and be strategic. So here are my best tips on how to pay for your dream career not through burnout or blind risks, but with patience and strategy.

1. Identify what pieces you want in your dream career

This could be a whole workshop, but I’ll keep it brief. Think about what elements you want to include in your career — and I say career in the broadest sense. These pieces can show up anywhere in your life; they don’t have to be full-time or even paid. Make a list of the different activities, roles, environments, and purposes you want to be part of your work life.

For example, some of my pieces include creative writing, talking about intimacy and relationships, helping others with goal setting and life planning, time in nature, and public speaking. These show up in a variety of ways in my career, and some play a bigger role in certain seasons than others. You might not have control over exactly how the pieces fit together, or how much time and energy you can give to each one, but you can make sure each piece exists somewhere.

2. Identify what you need to pay for with your dream career

Before you can plan how to pay for your dream career, you need to know what it will need to fund. Take time to consider your current and future lifestyle and expenses. (This is where a financial advisor can be helpful.) You don’t need exact numbers for everything, but knowing your big-picture expenses and when they’ll come up helps you make smarter choices.

The amount of money and stability you need affects how much flexibility you’ll have with your career pieces. The more financial responsibilities you have, the more you might need to rely on the financially stable parts of your work while keeping the others smaller until you can make them sustainable.

For example, if you’re planning to buy a home or have children in the next few years, you might want to take a more conservative approach to financial risk for now. That doesn’t mean you can’t take any risks, but it does mean being thoughtful about which ones you take and ensuring you have a backup plan for your non-negotiable expenses.

3. Start a dream career fund

No matter your path, you’ll want to set aside dedicated money to support your dream career. Start a “dream career fund,” a sinking fund you contribute to regularly. It can support your less lucrative career pieces, like self-publishing your book or going to grad school for your passion, or cover your living expenses during times of irregular income, like if you quit your job to start a business.

Having a designated fund gives you the flexibility to say yes to new opportunities without draining your emergency savings. You can open a separate account or use a budgeting app that lets you divide your money into goal-based “buckets.”

4. Choose your priorities and sacrifices

To reach your savings goals and make space for all the pieces that matter to you, you’ll have to make trade-offs. Start by identifying what’s a must-have and what you can sacrifice for now. You may have to say no to some big purchases or interesting opportunities that would take up too much of your time, in order to preserve space and money for the pieces that matter most.

That doesn’t mean you need to say no to everything forever. Instead of asking, “What am I giving up?” try asking, “What is not for right now?” Framing sacrifices as temporary makes them feel intentional rather than punishing. And don’t cut out all treats — you still need fun and joy to stay motivated! The goal isn’t deprivation. It’s to make sure your choices reflect your priorities so you can build your dream career without burning out.

5. Remember that your career is a long game

Building your dream career takes time. When you’re in a job you don’t love or saying no to things because you’re saving for something bigger, it’s easy to lose sight of why you’re doing it. Do what you can to keep your long-term vision front and center. That might mean making a cute vision board to inspire you when you’re feeling low, or writing a note from your future self to your current self, thanking them for the work and sacrifice that made your future life possible. Find what keeps you connected to your “why.”

And perhaps more importantly, be kind to yourself while you work toward your dream career. The pieces of your dream career will shift and transform over time. Some seasons, you may have to focus more on your most financially stable piece, and other times you may have the flexibility to give more energy to the fulfilling but less lucrative ones. You might even find a way to make the most meaningful piece the most financially sustainable! Always remember, your career will have ebbs and flows. One season is not your entire story, and things can and will change over time.

Your dream career doesn’t have to be reckless or impulsive. It can be thoughtful, well-planned, and built around what actually matters to you. You don’t need to make every financial move perfectly or give up on the pieces that don’t make much money. You just need to be intentional, be flexible, and play the long game. When you finally step into that new career, launch that business, or publish your first book, you’ll know you didn’t just stumble into it. You built it, piece by piece, on your own terms.

Danielle Nicholson is a holistic career coach who helps young women build sustainable, balanced careers that align with their bigger life goals. She draws on her background in counseling, education, digital marketing, hiring, and the creative arts to help clients design career paths that feel both fulfilling and achievable. To learn more about her coaching services, visit GenZCareerCoach.com, or say hello on LinkedIn!

November 12th: Wealth-building workshop alert! Join Chelsea along with Financial Planner and friend of TFD, Kellen Thayer, for How To Put Your Money To Work! This will be an info-packed 90-minute immersive workshop to learn the must-know wealth-building techniques for after you have covered the basics. Chelsea and Kellen will cover everything from the basics of real estate, mastering investments beyond the 401k, side income, entrepreneurship, and so much more! Click here to register! *Please note we’re still having some technical issues with the registration quiz, please email [email protected] if you have any issues!

While this section includes products and services from our paid partners, we only feature brands we genuinely like and use—and think you would, too.

FINANCIAL ADVISORY — Advisor.com: Dozens of people in the TFD community already trust and use Advisor! They’re one of the only financial advisory companies offering their services for a fixed, flat annual fee. Their team of advisors work for you, not commissions, and help you to achieve your financial goals through planning, investing, and more, no matter where you’re starting from.

INVESTING — Betterment: If you’ve been wanting to start investing but feel overwhelmed by where to begin, Betterment makes it super simple—even if you’re not a financial expert. With automated investing and goal-based planning tools, they’ll help you grow your money responsibly and sustainably over time. It’s a great option if you want to take control of your financial future without having to become a full-time market expert.

BUDGETING — Monarch: Our recommended Mint replacement! As we already shared in the main section of this newsletter, we highly recommend using Monarch to take the guesswork out of managing your money — use it to budget, set goals, and actually understand where your money’s going. Even better: there’s no ads, no selling your financial data to third parties, and no "premium only" upsells — just a clean, secure app that makes managing money feel way less overwhelming (and actually kinda fun?).

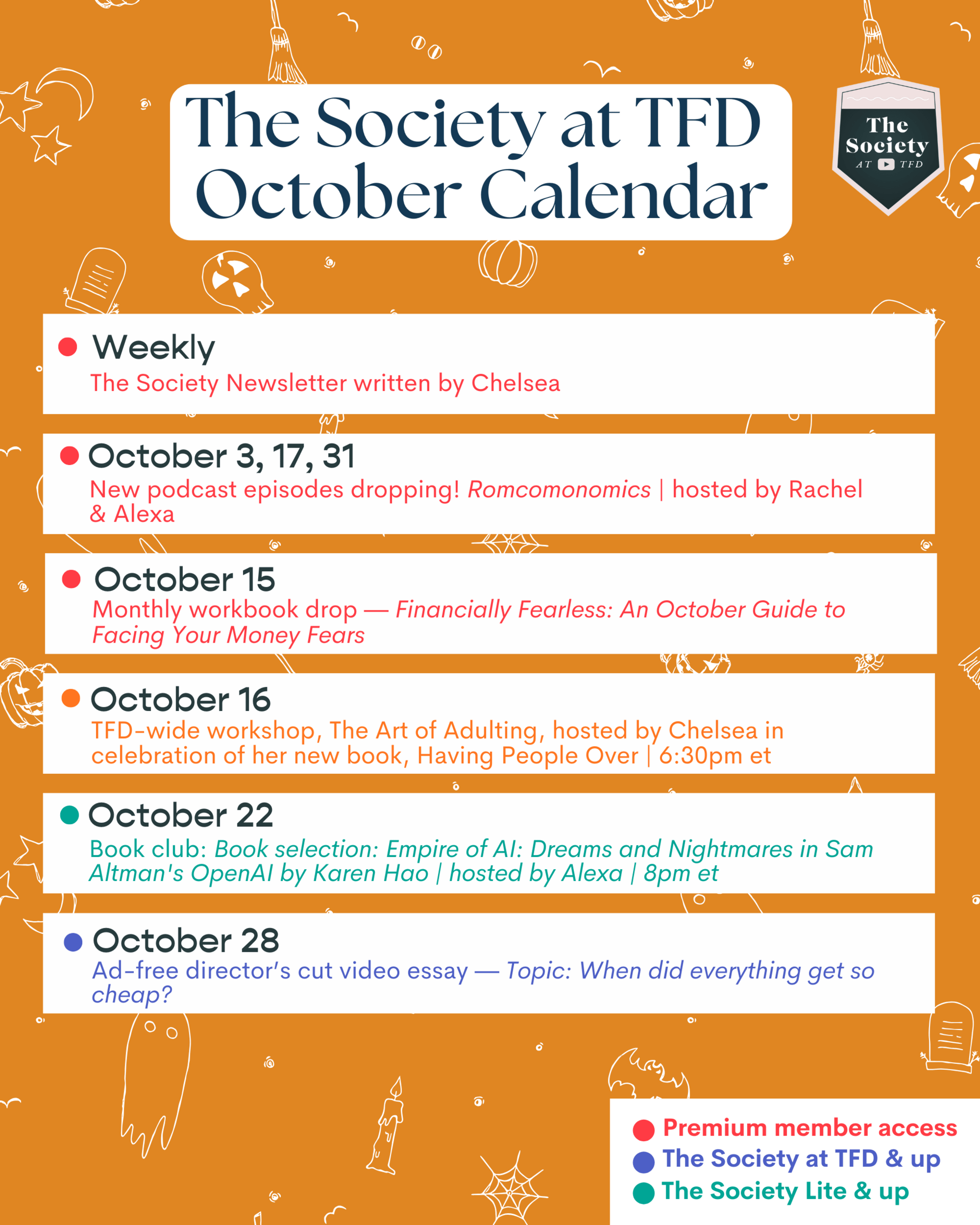

The Society at TFD is our members-only community with access available on both YouTube and Patreon. Joining The Society is the best way to directly support TFD! The Society offers the exact same things on both platforms, so choose whichever one you prefer!

We offer 3 tier options:

The Society at TFD Lite: $2.99/month

Monthly office hours with Chelsea to chat and get your personal questions answered

Access to our monthly book club hosted by TFD Creative Director, Holly

Illustrated tech backgrounds every month

Access to Society Discord

The Society at TFD: $4.99/month — includes everything in the $2.99 tier plus:

Monthly ad-free extended director's cut videos from Chelsea

Exclusive members-only events and workshops

Complete post archive (including exclusive members-only videos of Chelsea ranting on different topics)

The Society Premium: $9.99/month — includes everything from the previous tiers plus:

Weekly newsletter from Chelsea

Monthly multi-page workbook/guidebook on a different topic each month

Members-only capsule podcasts